🇩🇰💰 Become Financially Independent in Denmark

Build and grow your investment portfolio from 0 to 1.000.000+ kr and transform it into a sustainable, money-making machine. Without devoting your life to crunching numbers 😉.

50+ Lessons

6 Hours of Exclusive Content

Exact Strategies

Plug-and-Play for Max Profits & Minimum Taxes

500+ Happy Customers

🔥 Go Inside My Investing & Money Management System

See exactly what I invest in, how I minimize taxes, who I work with and what I buy … and how these are adapted specifically to life in Denmark.

This is my ultimate, bullet-proof and step-by-step system to achieve financial independence in Denmark.

If we haven’t met, Hi – I’m Mario 👋 and I’ve a fancy job in Maersk, run a side business, wrote two books, and traveled to 140+ different countries, all while building an investment portfolio in the millions. (And have kids too!)

I managed to do all this because I’ve cracked the “Denmark Code”.

Denmark is, after all, an incredible place.

It’s hands-down one the best locations in the whole world to go for financial independence — i.e. to be able to have enough passive income and/or savings as not to have to work for money anymore.

This despite the incredibly high taxes.

💥 Making It Happen to YOU

Perhaps you’re already working very hard, following all the rules, but still dream of that vacation in Maldives, or of buying your dream home, and wonder…

Why hasn’t that happened to you yet?

Chances are you’ve been searching for the answers for a while. You’ve been working hard and trying many different things, but nothing has built momentum.

You don’t feel like you’re moving fast enough.

You don’t feel like the things you’re doing are making a real difference in your ultimate success and personal wealth.

The Ultimate Investing in Denmark Course will give you the tools you need to finally set yourself in the path of investing riches. You will crack the mental blocks that have been holding you back financially and replace them with proven and powerful frameworks that the rich use every day.

- This will be specific — I include the exact concepts, systems and examples you can use right now.

- This will be fast — it is 3+ hours of new material that you can apply immediately. You can take it at your own pace and revisit it whenever you want.

- This will be incredibly practical — if you’ve already tried a laundry list of random hacks and “trying harder” and you want to go straight to the point to what truly works, this course will give you the exact actionable steps you need to take.

🐚 Have you ever wondered…

- How is it possible that the rich pay less in taxes than you do? And what do they know that the average investor doesn’t?

- Why are expats in Denmark always “cheated” by obscure rules and regulations? And what can you do about that?

- What is the easiest way to get started with investing?

- How can you get a million-kroner portfolio “automatically” — without spending too much time on it?

I wondered too, and went through a long 10+ year long process to discover all the hidden ins-and-outs of financial independence and investing in Denmark.

I took all this and condensed it and optimized it into a system that gets all of these pieces working together, seamlessly.

THIS is what this program is about. It’s the culmination of this enormous research into one, proven, step-by-step system you can use immediately.

The best thing is that you don’t need to have a highly-paid job, a fancy degree or a two-income household to get down through this path.

You just need to take action.

🦁 Create the Life You Want

I’m a “normal” guy—but, while working at a normal job, in a normal company, I built a lifestyle that let me to:

🌍 Travel to 140+ countries

🧳 Choose my jobs because I like them and not because of the pay — e.g. I turned out offers for 50% more salary to avoid longer commutes, more work and/or what looked like boring colleagues

🎬 Build a very profitable and fun side hustle while working on it just four hours a week

💵 Have now more than ten years of expenses saved up. I could theoretically be without a job for that long and still keep my current lifestyle. (With all the peace of mind that comes with).

… and I did all that as a “normal” person. My job is not especially well-paid, I didn’t have “angel money” helping me out and have not yet had a big home-run. I’m married and have two kids.

I’ve been living in Denmark for the past ten years, and credit my success to the strong and structured system – what I teach here! – that made all this possible.

😢 But It Wasn’t So Glamorous Before

While only in my mid 30s, I’ve lived through more crises than most people go through in their lifetimes. It comes with growing up in Argentina:

🇦🇷 Hitting Bottom & Totally Broke

🖨 Argentina had hyperinflation in the late 1980s and early 1990s. We didn’t get to Zimbabwe-levels, but it felt just as nasty and unraveled very quickly: prices went up 4929% in 1989 and 1345% on top of that in 1990.

Inflation can be a killer, and I saw my grandparents’ decades of hard work go “puff” – they got drowned as they didn’t see the crisis coming and didn’t prepare accordingly.

❤️🔥 In 2001, just ten years later (!), Argentina fell into a massive economic crisis – featuring the world’s largest ever sovereign debt default, big devaluation (again), bank accounts frozen, 20%+ unemployment, etc.

That one was even nastier. If you’d savings in the bank, you were f*** – even if you had $50k, you could only take out $250 a week. My family, like all in the country, got to see hard-earned savings frozen away for more than a year, with a devaluation (and, obviously, a loss of value) in the meantime. It was brutal.

📉 In 2008, we got hit by the global financial crisis like all other countries: devaluation, higher unemployment, recession, etc.

I was more of a grown up by then. I finished my bachelor’s degree just by the time Lehman collapsed, and in the horrific job market that came after it took me more than a year to land my first job. There was a lot of ramen and broken dreams in the meantime.

😰 That job didn’t work out (I quit/got fired after three days) and I plunged myself into the darkest, deepest hole I have ever been at.

I not only had zero (or negative) savings, but also gained weight and was even the only single guy among my friends.

I don’t want to sound too dramatic, but being broke in South America is not cool.

On a dark, winter morning — the day after officially quitting that job, I decided that I will never have money problems again. I’ll turn the page over.

🇩🇰 The Path to Recovery

Instead of following the path that I was “supposed to” do, I decided to break the mold:

🖥 It was then that I launched my first business — for which I worked incredibly hard, and was pretty lucky with: it turned enough profit for me to live vs. getting an entry level job.

I used the business as a springboard to move to Denmark, studied entrepreneurship in CBS and at school got my first job in Maersk as an intern.

📚 In parallel, I decided to learn and research about money, investing, building wealth, and achieving financial independence. I was on a mission to live my dreams.

I relapsed (for a bit) in 2013 and 2014 with a bit of a career and business mess, but have been on the upswing ever since.

All throughout, I kept learning, experiencing, developing myself — and now can confidently say I’m at a very strong position.

👉 My Mission to You

Now I want YOU to also get into a strong position. I want YOU to never have to worry about money again.

I want you to:

- Have the ability to take care of yourself and the people around you

- Attract the people, things and experiences that you want to have your life

- Save for the bad times, all while spending without guilt and investing with conviction

- I want you to never have to worry about money again.

It’s a tall order, but we’ll try!

🤯 The Denmark Complications

Denmark is the hardest place in the world to invest. (Or, if it’s not, it comes close!). In Denmark you’ve a unique combination of:

- The highest capital gains (i.e. investing) taxes in the world — at a whopping 42-45%

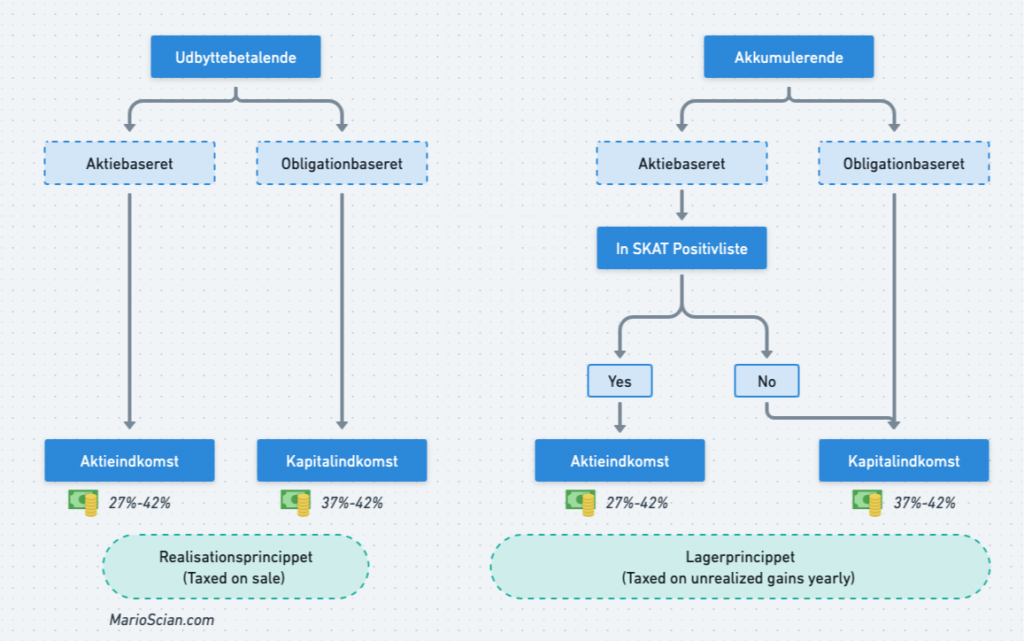

- TWO types of taxation, and a list for SKAT (in Excel, lol) that says which fund will pay which type of taxes

- “Unrealized Gains” cases — where you pay taxes on your investment gains even if you didn’t sell (!)

- Few platforms/investment brokers that are willing to do all the paperwork for SKAT

- …even EXIT FEES when you leave the country

BUT – Even with all that, you can still achieve financial independence in Denmark.

You just need to know which buttons to push, where to focus, what to prioritize… Hence this course.

To show you how complicated it is…

😱 If you get the wrong asset you could end up paying thousands more in taxes.

🔎 Searching for Solutions

I’ve spent over ten years (!) learning and researching about investing and investing in Denmark specifically.

I poured over 200+ books, interviewed experts and took a multitude of online courses.

The gist: it’s no surprise that successful smart people spend lots of time focused on their money.

The solutions they come up with are brilliant and often counterintuitive. The hard part is finding people who will actually share their methodology.

I found these people, and I pulled out all their advanced tactics, never-discussed strategies, and mindset shifts behind their finances.

Then I took action. I took my own money and built my own advanced personal financial system. I incorporated my own insights on history, taxes, systems, and 10+ years of experience living in Denmark.

In this course, I share the condensed and specific material.

Who’s This For? 👇

🍵 People Serious About Becoming Financially Independent

✅ You are an expat in Denmark or a Dane that is serious about investing for the long-term

✅ You want to to become financially independent in your 30s or 40s

✅ You want to do things right – but want to pay as little tax as legally possible

✅ You want to know your optimal allocation between housing, investing stocks and other assets

✅ You want to save time and money by following a proven step-by-step investment system

✅ You’ve your “act together” and just need a guiding hand to help you prepare in a structured and straight-forward way

👉 You’re aware you’re about to spend thousands of your live savings and want to go the extra mile to make sure that you couldn’t have done better.

💀 Who’s the Course NOT for?

❌ You’re looking for a magic bullet that will cause your life to dramatically improve without any effort. There’s no secret here. It’s just about putting in the work and stacking the deck in your favor in whatever way you can.

❌ You want to “get rich quick” and expect life-changing results in just one or two years.

❌ You’ve no savings and no job and high expectations. If that’s your case, wait until you’re in a stronger position. I won’t be able to help you until then.

🇩🇰💰 The Ultimate Investing in Denmark Course

🔥 40+ Lessons, Sections & Toolkits

699 kr. or 3 Payments of 266 kr.

Easily cancel anytime. Risk-free 30-day 100% money-back guarantee.

✅ The most complete super guide to investing in Denmark in English.

✅ 50+ Lessons on Everything You’ll Ever Want to Know on Investing

✅ The Exact Strategies to Maximize Returns and Minimize Taxes

✅ See Exactly How Much I Have Invested & Where Specifically

✅ All Danish Rules, Taxes & Regulations You’ll Ever Need to Know

✅ The Financial Dashboards: FIRE, Savings Rate, Cashflow + Apps

✅ Lifetime Access to My Private Online Forum and Community

✅ Bonus Course Included: The Financial Freedom Blueprint

✅ Bonus Course Included: The Denmark 10 Money Mistakes (and How to Avoid Them)

✅ 30-Day Money Back Guarantee.

🔐 Lock In The Cheap Price

I update the course regularly, and with each update add new sections, videos, spreadsheets, Q&As and a lot more.

The updates are free for anyone who bought the course.

But each time I update the course, the price for new buyers goes up.

🌟 100% Satisfaction Guarantee – No Risk, Money-Back Promise

I want the investment in this course to be an absolute no-brainer for you. So, if you go through all modules, complete all the exercises, and still don’t find the course useful, drop me an email within 30 days of buying the course and I’ll happily refund your full payment.

💕 What Happy Customers Have to Say

Buyers say very nice things about the course. Here’s what quite a lot of them had to say.

📚 What Is Included in the Course

The course is divided into six modules with 30+ video lessons (all with transcripts!), including:

💥 Module 1 – Intro

- Overall map of how to approach this in the most effective way

🤑 Module 2 – Financial Independence

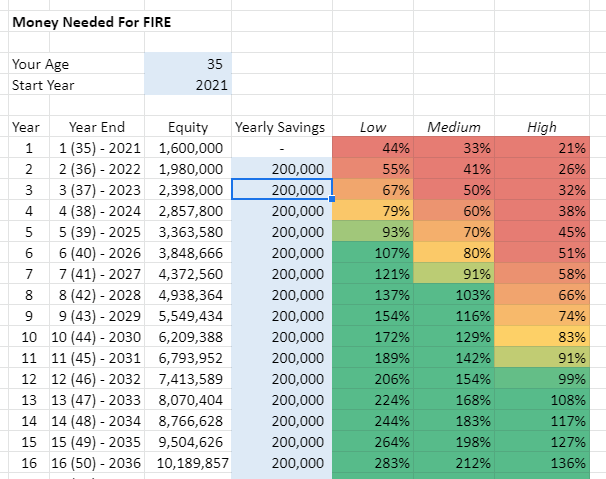

- Introduction to FIRE (Financial Independence, Retire Early) + FIRE in Denmark

- Exercise: Calculating your “FIRE number” i.e. how much $ you need to “retire” early

- The two only true paths to earn more money

- How to spend less without having it “hurt”

- How to live a “rich life”

- Templates: My 3 popular Financial Independence Dashboards

💰 Module 3 – Investing Basics

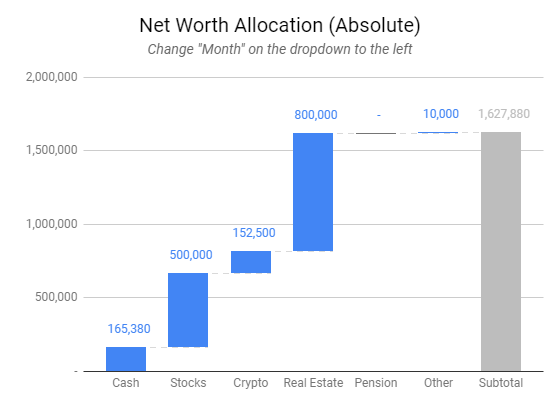

- My Portfolio — “behind the scenes” walkthrough my real estate, stocks, crypto, pension holdings and more

- Overview: Is real estate a good investment

- Introduction to Stocks and Index Funds

- Investing Best Practices: Dollar Cost Averaging, Tracking & Rebalancing Portfolios

🇩🇰 Module 4 – Investing in Denmark Deep Dive

- The BEST Plan for Denmark-based investors (taking everything into consideration!)

- Overview of Investment Brokers (and which is best?)

- Investing in Stocks and Indexes, including how to buy your first stock

- Investing in Bonds

- Everything you’ll ever need to know about taxes — including two visualizations

- Aktiesparekonto: the low-tax option

- Månedsopsparing for automatic investing (and its alternatives!)

- Cryptocurrencies, Pension, Art and other investments

- (Advanced) Tax Loss Harvesting

- “Leaving Denmark” – Rules and tax liabilities if you move out

🗺 Module 5 – Conclusion and Q&A

- Regular live Q&As with buyers of the course

- Links to a list of curated resources

🏦 Extra – Financial Freedom Blueprint

I’m including my Financial Freedom Blueprint course for FREE as part of this purchase. It’s one more full course!

It includes top-tier, advanced lessons on:

- The Mindset Shift: From Money to Value Creation

- Understanding True Wealth: Assets, Liabilities, and the Illusion of Money

- Building Your Personal Asset Portfolio

- Overcoming Psychological Barriers to Wealth + Inevitability Thinking

- Strategic Wealth Building: Beyond Saving and Investing

📲 Bonus – See Behind the Scenes My Own Investment Portfolio

One of the most helpful and eye-opening things I did was to learn the exact investment portfolios, asset allocations from very successful people.

The first time I saw them, it was wow. My jaw dropped.

I want to do the same for you. That’s why I included a bonus section where I go through and breakdown my investment portfolio and asset allocation — including the thinking behind it and how much I have invested in each asset.

(This alone is worth the price of the course!)

🍀 2025: Massive Course Update

The course is continuously updated (for free, no subscription bs), and the latest update includes:

- How to approach market downturns (as it happened in 2022 and 2025)

- The two things you must absolutely do (and get in order!) before you start investing

- The Top 10 Denmark Money Mistakes – and how to avoid them

- Simple step-by-step walkthroughts to help you buy your first stocks

- New full-on community platform to connect and ask questions to me and other investors

These updates – again – are all for free. I just raise the price of the course for the new buyers with each update 😉.

Included: Get Access to My Detailed Templates

🧭 Bonus – Financial Independence Dashboards Included

Included in the price is my own Ultimate Personal Finance System – the exact dashboards I use myself for saving, investing and allocating my net worth—and achieving a freedom most only dream of.

FIRE Dashboard 🔥

This sheet calculates how much you are worth and how that worth is calculated.

Including:

- Financial Independence journey calculator, with the “retirement year” check

- Net worth calculator, with month-to-month progression

- Net worth allocation graphs

Savings Rate Calculator 💳

he one KEY metric for Financial Independence is your Savings Rate. You MUST know what your Savings Rate is, and this sheet will calculate it for you.

Includes:

- “Level 1” and “Level 2” savings rate outlines

- 6 Scenarios (and expansion potential for more!)

Cashflow Projection 📊

Know how your finances progress from month to month, for greater control.

Includes:

- Ultra-detailed month-to-month budgeting option

- The same sheet I have used since 2014!

🤝 Someone You Can Trust

When I was just starting to learn about money and finance, I wished for someone to just take my hand and guide me through it all.

Someone who’d show me where the real wins were and keep me from making big (and costly!) mistakes.

Someone who cared about helping me live a truly wealthy life, not just someone who’d talk about cutting coupons or obsess over numbers.

And most importantly, someone who’s got the thumbs up from the people I trust.

🎥 10.000+ Social Followers

I’ve popular, free content across the web – from blog, to YouTube, to Instagram and beyond.

🇩🇰 Denmark Angle

I’ve been in Denmark for 10+ years and know the system’s nuts-and-bots to the very details.

🏝️ Walk the Talk

I’ve my fancy corporate job, side business, two kids, work out every day and have traveled to 140+ countries.

💬 Frequently Asked Questions

🖥 How long will I get access to the course?

For life! You get access to the course and all future updates for a one-time price. This is not a subscription.

🇩🇰 I don’t live in Denmark. Will this course still help me?

Yes! You’ll still learn the methods, strategies and mindsets behind long-term financial independence. Also, while Module 4 (which is the longest in the course) is Denmark-specific, the other four modules are about investing and financial independence at an international level.

🍎 I know NOTHING about investing, will this help me?

Yes! My system and recommendations are ultra-simple. Even the more “advanced” topics like tax loss harvesting are straight forward. Investing need not be complicated.

🌏 I only have 1.000 kr month to start investing, is it enough?

Yes! You don’t need 10K or 20K to start investing. 1.000 kr is more than enough… and 1.000 kr over 1 or 2 years will start becoming serious money!

💶 Will you give me stock picking advice?

This course is not about stock picks, loopholes, or other random investments. Instead, I’ll give you a no-nonsense system for making the most of your money without devoting your life to crunching numbers.

👾 How will I get support?

If you have any technical problems with the course or a lesson needs to be clarified you’ll be able to reach out to me directly. But keep in mind this doesn’t include 1-1 personalized consulting.

💫 Does the course get regularly updated?

Yes! The course is updated frequently with the latest developments in the market, new tools and feedback I receive.

For Example – In 2025 I changed my strategy as I bought a new house and I made videos explaining how I rebalanced.

The updates are always free.

💻 What technical equipment do I need to access this course?

It’s better if you’ve a laptop (or desktop) computer, but the lessons and course are also optimized from your phone if that’s what you prefer.

💌 Start Your Journey to Financial Independence

If you have any questions or concerns about the course, you can always reach out to me via email (see the red bubble) or Twitter or YouTube or anywhere 😀. I’ll be happy to help!